Transferring Funds to My Bank Account

How do I transfer funds from my ProPay account to my bank account?

When you log in to your ProPay Payments Account, you will see your available balance. This is the amount available for you to transfer to your bank account. Depending on your country of residence, there may be additional transfer options available to you.

You may transfer up to the amount of your available balance to your checking account (less the ACH transfer fee) by using the Transfer Funds menu option:

-

In the “Transfer Funds From” field select “My ProPay Account”

-

In the “Transfer Funds To” field select “My Bank Account”

-

In the “Amount” field enter the amount that you would like to transfer

-

Click the “Review Transfer” button

-

If the transfer information is correct press the “Submit” button (if incorrect, you may click the Edit button to return to the previous page)

There may be a fee to transfer funds from your ProPay account to a bank account. Please log into your account and view the fees section to view the fees for your account.

Be sure that your checking account and routing numbers are correct. If the transfer is rejected, the funds will return to your account and a returned ACH fee may be charged to your account.

What is the fee to transfer funds to a checking account?

There may be a fee to transfer funds from your ProPay account to a bank account. Please log into your account and view the fees section to view the fees for your account. When a transfer is initiated the fee will be deducted from your remaining ProPay account balance.

Can I have a check mailed to me?

No. ProPay is a paperless system. All transactions are done electronically to increase ease of use and efficiency. We do offer multiple other methods to electronically transfer or use the funds in your ProPay account.

Can I transfer funds to any checking account I want?

As long as the account is a valid checking account within the United States and can accept incoming ACH (electronic check) transactions, you should be able to use the account to transfer funds from your ProPay account.

It should not matter if the account is a personal or a business checking account, but we do suggest that you contact your bank to be certain.

Can I have funds automatically sent to my checking account?

No. All transfers to your checking account must be initiated by you from within your ProPay account.

Can I transfer funds to a savings account?

Yes. When initiating the transaction, there is a place to designate whether the account is a “Savings” or a “Checking” account.

How do I change the checking account information stored in my profile?

Here is how to add, verify, or update the routing and checking account information stored in your Account profile and some suggestions:

-

Login to your ProPay account.

-

Select “Edit Profile”.

-

Click the “Change/Add Checking Account” link.

-

Make any necessary changes or entries. Please do not enter any spaces or dashes.

-

Click “Submit” to store your information in your ProPay account profile.

-

The checking account validation process will immediately begin.

ProPay Payments strongly suggests that you contact your financial institution to verify that you have the correct routing and account numbers for ACH transactions. Please do not enter numbers from your deposit slip.

Where can I find my routing and account numbers?

Before using any account or routing information to transfer funds from your ProPay account, we strongly suggest that you contact your financial institution to verify your routing and checking account numbers and that your account can accept incoming ACH (electronic check) transactions.

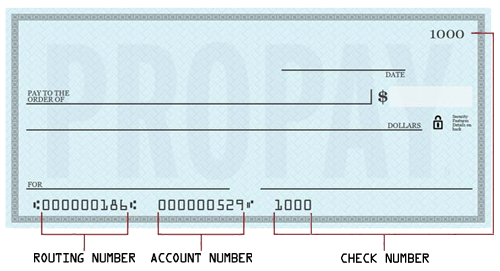

The account and routing information required will normally be found on a check from your account. Information from a deposit slip cannot be used, because a deposit slip is an internal routing document for your bank.

The routing number will normally be the first 9 digits on the bottom left-hand corner of your checks.

The checking account number usually follows the routing number and can be any number of digits. The length of your checking account number as printed on your check will vary from bank to bank.

How long does it take to transfer funds?

A funds transfer to a U.S. based checking account will generally be completed in 2-4 business days (depending on the bank to which you are sending the funds). The length of time that international electronic funds transfers or wire transfers take will vary by country and receiving financial institution.

What does ACH stand for? What is the difference between an ACH transaction and an electronic check?

ACH stands for Automated Clearing House. ACH is the standard for sending funds electronically from one account to another in the United States. With your ProPay account, you may generally send money to any U.S. based checking account or pull money from your personal U.S. based checking account, via the ACH Network.

We sometimes use the terms ACH and electronic check interchangeably on the website. The terms are synonymous.